Running a successful business requires effective financial management, which includes safeguarding your hard-earned money. When it comes to choosing where to safely place your money, selecting an account at an FDIC-insured bank should be at the top of your to-do list. In this article, we will discuss how you can secure your business finances and ways to maximize your deposits through various strategies, including sweep accounts, business money markets, IntraFi℠ Network Deposits℠, and more.

The FDIC: Understanding It’s Limits and Protection

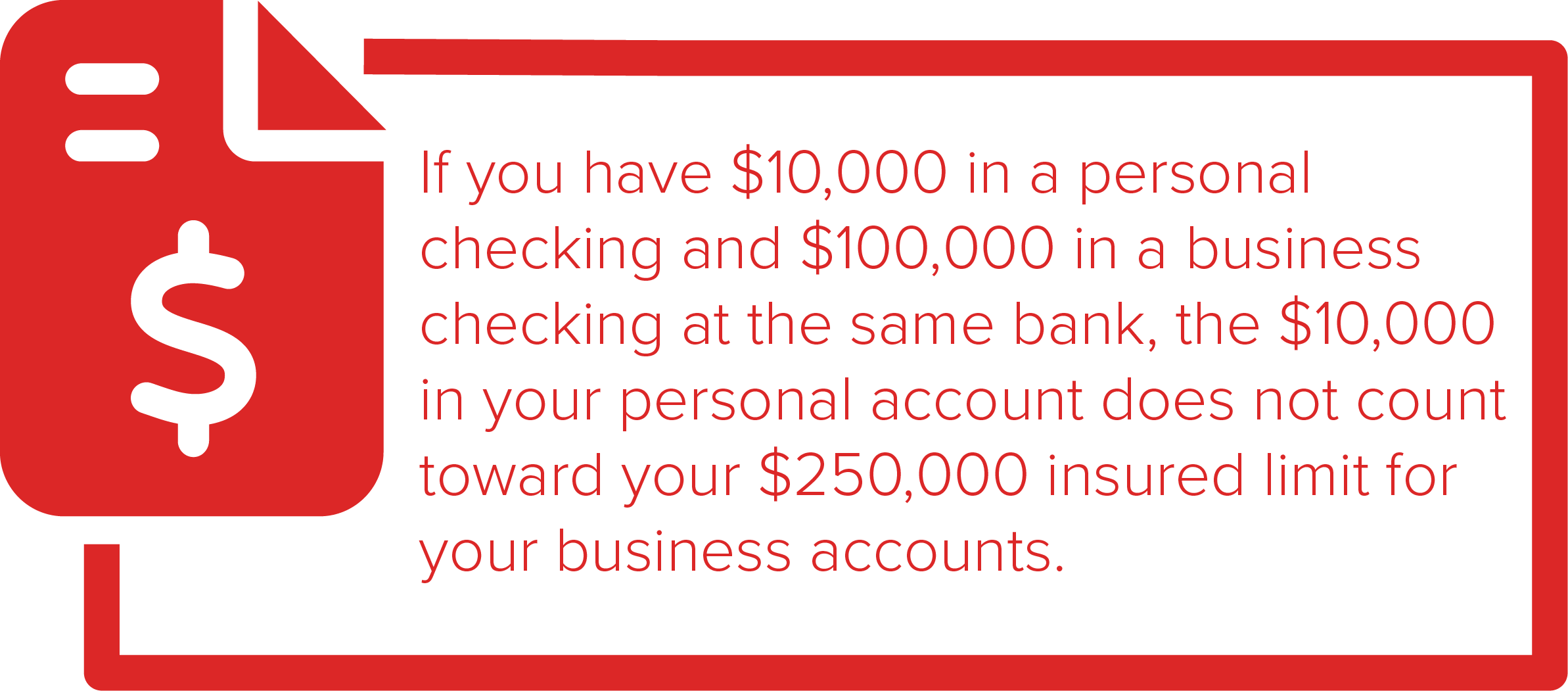

The FDIC is an independent agency of the U.S government that provides deposit insurance up to $250,000 per depositor, per insured bank, per account ownership category. All deposits owned by a business at the same bank are added together and insured up to $250,000, separate from personal accounts of the owners.

To secure your business funds with FDIC insurance, follow these key steps:

- Verify FDIC Membership: Most banks display the official FDIC logo on their websites but you can also confirm by using the FDIC’s BankFind Suite tool.

- Maintain Proper Records: Keep accurate records of your deposits and account ownership structures. The FDIC relies on these records to determine insurance coverage in the event of a bank failure.

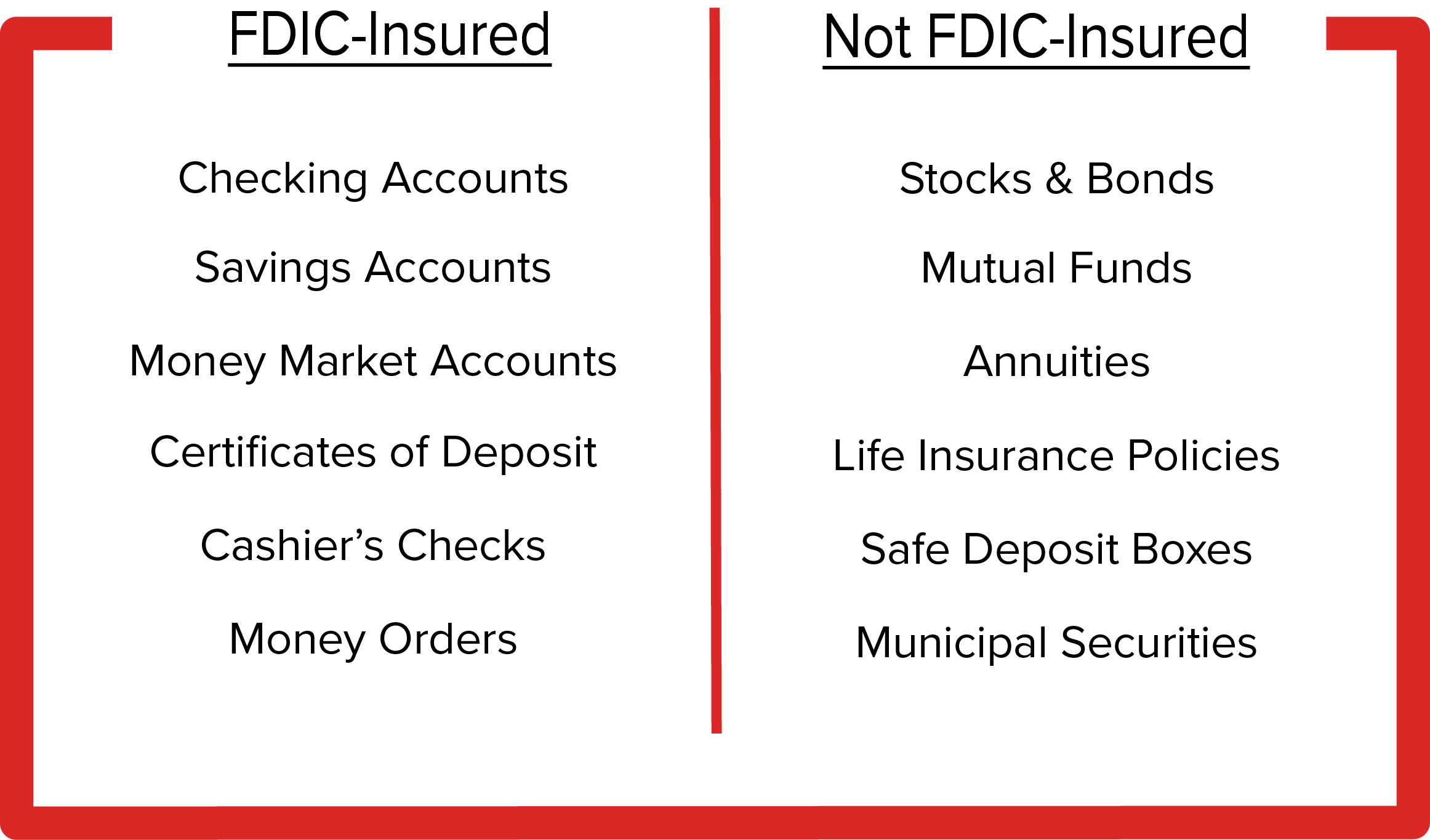

- Learn the Account Types That Are Insured: It’s important to know that the FDIC does not insure investment products nor deposit boxes. We’ve compiled a list of insured accounts vs not insured below.

Maximizing Deposits and Coverage

Now that we’ve covered the importance of FDIC coverage, let’s explore strategies for maximizing your deposits and coverage:Sweep Accounts

IntraFi℠ Network Deposits℠

Business Money Market Accounts

Business money market accounts combine the liquidity of a traditional business checking account with higher interest rates. These accounts often come with tiered interest rates, meaning the more you deposit, the higher your interest rate will be.Certificates of Deposit

CDs offer fixed interest rates and terms that range from a few months to several years. They are a low-risk way to lock in a specific interest rate, providing a predictable return on your investment.Treasury Management Services

Leverage treasury services to optimize your cash flow and reduce idle funds. Here at Farm Bureau Bank®, you have access to the following services:- Remote Deposit Capture

- ACH Payments

- ACH Collections

- ACH Positive Pay

- Check Positive Pay

- Wire Transfer Services

- Sweep Account

- Credit Card Processing

- Account Reconciliation

- Business Online & Mobile Banking

Business Credit Cards

Consider using business credit cards that offer cashback rewards or other perks. By using a business credit card for your expenses, you can delay cash outflows, maximize cash-on-hand, and take advantage of rewards programs.Conclusion

Protecting and maximizing your business deposits are essential aspects of financial management. FDIC insurance offers a safety net, but it's equally important to explore deposit maximization strategies like sweep accounts, business money markets, IntraFi℠ Network Deposits℠, and more. By combining prudent deposit management with FDIC coverage, you can safeguard your business's financial future and make the most of your hard-earned money.At Farm Bureau Bank® you have access to a dedicated team of knowledgeable bankers and tailored services that will help align your business to its specific needs and goals.

Tags: business banking, deposits, FDIC insurance,